Uncategorized

AMD Caught In WallStreetBets Drama As Shady Robinhood Dares To Limit Trading – Hot Hardware

https://hothardware.com/news/amd-robinhood-gamestop-gme-shorts-wallstreetbets

This week has been a crazy one for seemingly down and out companies that have been severely impacted by the COVID-19 pandemic. We’re of course talking about GameStop, and to a lesser extent companies like AMC Theaters and BlackBerry. It’s a long story, and we highly suggest that you catch-up on our previous coverage if you’re new to all the drama.

However, the Cliff’s Notes version is that Wall Street hedge funds have been shorting GME shares for the long haul, hoping for the eventual demise of the company so that they can rake in billions in profit. Reddit community WallStreetBets, however, has decided to “Stick it to the man” by buying shares of GME, which has sent its stock price soaring. GME, which was trading at below $10 a share in mid-2020 is now trading at around $325. Needless to say, the “little guy” day traders that got in early have been making bank, while hedge funds are shaking in their boots and lashing out in epic fashion.

So Where Do Robinhood And AMD Factor Into All Of This?

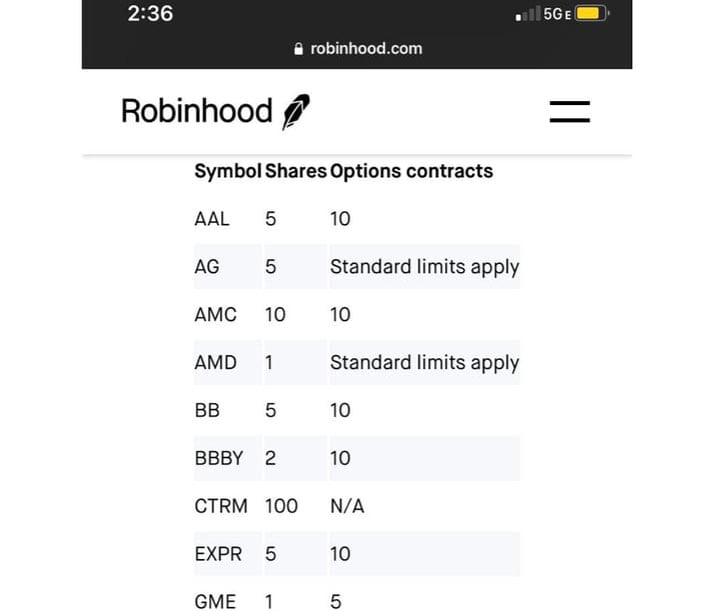

That brings us to Robinhood, which drew the ire of WallStreetBets, day traders, and even lawmakers after it announced it would be “restricting transactions for certain securities to position closing only, including $AAL, $AMC, $BB, $BBBY, $CTRM, $EXPR, $GME, $KOSS, $NAKD, $NOK, $SNDL, $TR, and $TRVG.” Robinhood claimed that it was making the move to protect its customers from “significant market volatility,” even though most folks dealing with those particular stocks knew exactly what they were doing.

The trade blockade caused GME and AMC shares to drop 21 percent and nearly 50 percent respectively on Thursday, before [mostly] recovering from those losses on Friday.

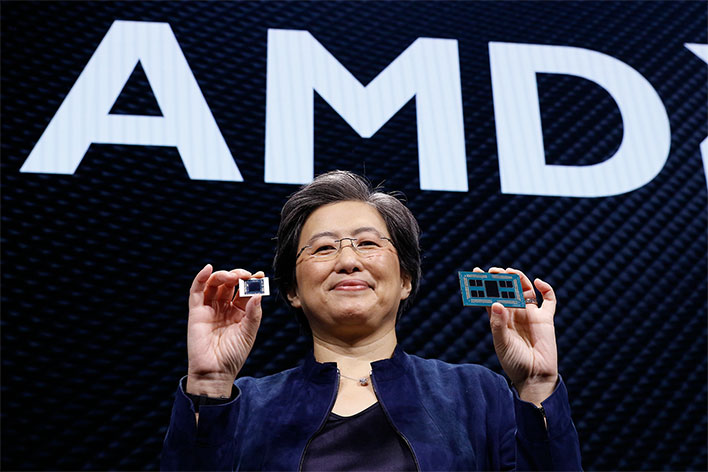

But one company that was caught up in this short selling/WallStreetBets counterattack has been AMD. AMD is a company that is seemingly unrelated to the whole GME drama (other than it making the CPUs and GPUs that go into game consoles), but it too was placed on Robinhood’s restricted stock list.

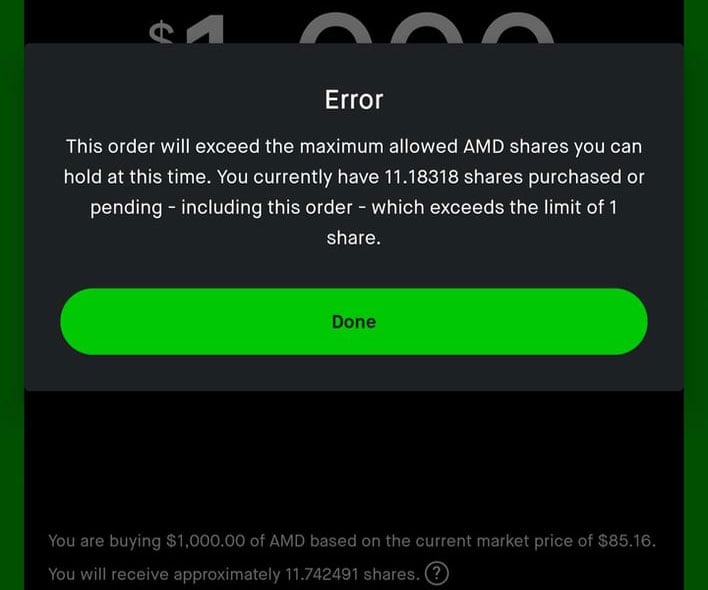

On Thursday and Friday, Robinhood limited its users to purchasing just a single share of AMD. As you might expect, there was an immediate outcry about this turn of events. Unlike GameStop, or many of the other companies that were targeted by Robinhood, AMD actually has solid financial footing.

In fact, AMD witnessed a 45 percent uplift in revenue year-over-year for 2020, and a 52 percent uplift in full-year profit to $4.35 billion. All of AMD’s business units were on fire from standalone Ryzen and Radeon GPUs, to its semi-custom chips used in the PlayStation 5 and Xbox Series S/X, to its EPYC data center processors. Despite the big earnings win, AMD was greeted with a dramatic drop in its share price, and subsequent interference from Robinhood.

Why Is Robinhood Targeting AMD Now?

Redditor Bvllish was among the first to bring attention to the AMD slight by Robinhood, and blasted the move, stating:

This is important because it’s blatant manipulation of AMD’s stock. By limiting buys on a stock, Robinhood is creating artificial sell pressure which can lower the stock price. AMD’s short interest (number of people betting that AMD’s stock price will go down) has also risen in the past month. AMD also happens to be one of the most held stocks on Robinhood. An attack of AMD’s stock is an attack on the company.

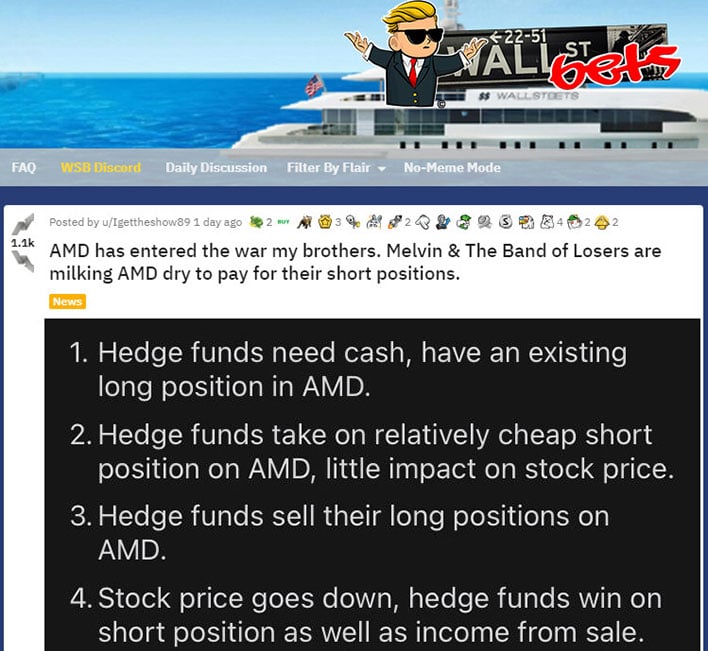

There has been quite a bit of activity around AMD during the past three weeks, with short interest having doubled from 52 million earlier in January to a current level approaching 110 million. Given AMD’s booming financials, WallStreetBets and other day traders smell a rat (or perhaps shorts selling long positions on AMD to maintain liquidity after taking a beating on GME).

“Notice how [mainstream media] are saying that an earnings beat was ‘expected’ to explain the [share price],” added zqv7. “And yet, there was no run-up before earnings to actually price it in. Suits covering suits.”

The Battle Against Robinhood And Shorts Is By No Means Over

The popular opinion seems to be that WallStreetBets and its legion of self-labeled “degenerates” are gearing up to now push AMD stock, and Robinhood doesn’t want to get caught flat-footed. However, these restrictions are only helping to further drive distrust of the company by its users and scrutiny from lawmakers, including the SEC — something that most trading companies try to avoid at all costs.

The mockery of Robinhood has grown in just a few days as its actions — while legal — are at odds with a movement that is determined to take on top Wall Street hedge fund firms. The degenerates are hellbent on propping up companies that are down on their luck, while also making some money for themselves.

It appears that some “degenerates” are even using their newfound wealth to openly mock Robinhood out in broad daylight (as witnessed by the video embed above). This is a quick about-face in fortunes for Robinhood, which has been praised for its ease of use and accessibility to casual traders. However, the twist of Robinhood’s namesake to “steal from the rich and give to the poor” seems to have been turned upside down here, which explains why its feet are now being held to the proverbial fire.

As of now, it appears that AMD has been removed from Robinhood’s list of restricted stocks following the outcry, but we don’t know if that will still be the case tomorrow when the market officially opens again. Whatever the outcome, the damage to Robinhood’s reputation has clearly already been done, and it will be interesting to watch the fireworks if the SEC takes action against the company next.