Technology

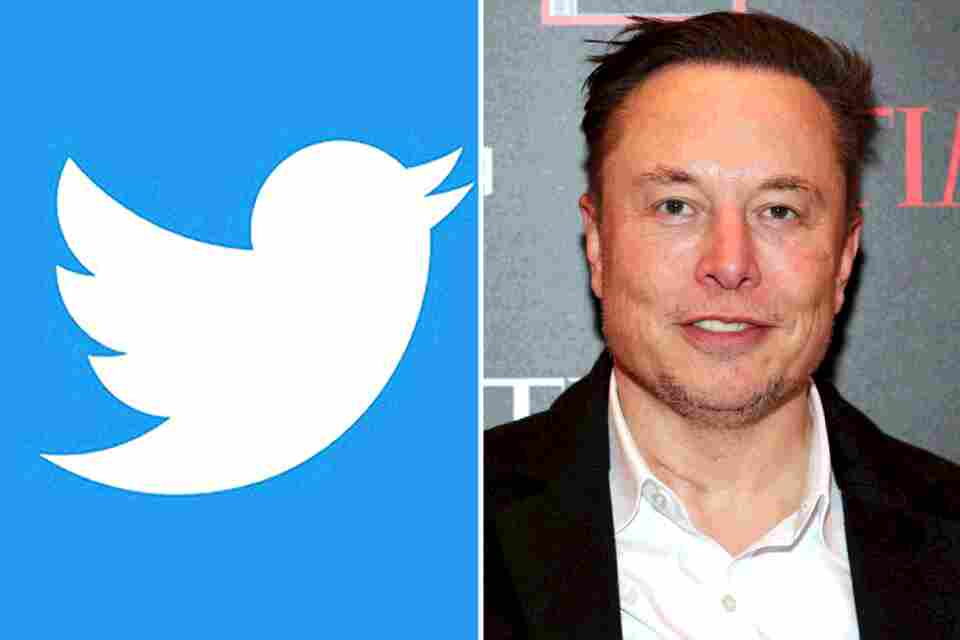

Twitter considering ‘poison pill’ to STOP Elon Musk buying company, expert claims

TWITTER’s board is fighting Elon Musk’s bid to takeover the social media giant.

Financial analysts have dissected Musk’s bid and are unsure of his ability or willingness to shuffle $43billion around.

Musk presently owns about 10% of Twitter and is making a push to buy the remainder

The Wall Street Journal reported that Twitter executives are considering a “poison pill” that would stop Musk’s takeover effort.

Earlier this week, Musk bought almost 10% of Twitter for roughly $3billion – and now he’s pitching the Twitter board on a full buyout for an additional $39billion.

To prevent the Tesla boss from taking control, shareholders would have to reinvest in Twitter to dilute Musk’s existing ownership and raise the price tag.

The company convened to privately discuss the proposal – but Saudi Arabian prince and major Twitter shareholder Alwaleed bin Talal has already rejected the offer – and he did it publicly, on Twitter.

Read More in Elon Musk

“I don’t believe that the proposed offer by @elonmusk ($54.20) comes close to the intrinsic value of @Twitter given its growth prospects,” bin Talal tweeted. “Being one of the largest & long-term shareholders of Twitter, @Kingdom_KHC & I reject this offer.”

The richest man in the world could, of course, buy anything if sufficiently motivated.

But his financial philosophy is strange for a billionaire – he has discouraged people from owning physical possessions and does not own a house.

In 2020, the Wall Street Journal ran a story dubbing him “Tech’s Cash-Poor Billionaire” because he takes no salary and finances his life by borrowing against his stock – he would likely have to part with some of his Tesla or SpaceX holdings to make this acquisition happen.

Most read in Tech

“I don’t care about the economics at all,” Musk said during a live TED Talk this morning.

If Musk pulls the acquisition off, it wouldn’t be the first time he’s staked a company using a ton of his own capital.

After making out from his first company Zip2 with $22million, 27-year-old Musk took almost half of his newly earned capital and founded X.com.

X.com was an online financial services company – one of the first of its kind – and eventually merged with PayPal, which was backed by Silicon Valley legend Peter Thiel.

When Ebay bought PayPal in 2002, Musk’s shares in the company were realized to the tune of $165million dollars – propelling him into a class of untouchable tech-titans.

“I don’t like to lose,” Musk said during this morning’s live TED Talk.

Read More on The US Sun

Musk’s first reaction was to laugh about his hostile takeover attempt – leaving some questioning the seriousness of this entire stunt.

While it may not be Musk who ends up with the keys to Twitter, he may have confirmed that the company is for sale – a tech company, rather than an individual, could make a more convincing and less controversial push.

We pay for your stories!

Do you have a story for The US Sun team?

Email us at exclusive@the-sun.com or call 212 416 4552.

Like us on Facebook at www.facebook.com/TheSunUS and follow us from our main Twitter account at @TheSunUS