Uncategorized

Exxon Defends Dividend After First Annual Loss in Decades – Yahoo Finance

https://finance.yahoo.com/news/exxon-19-billion-writedown-caps-123212851.html

(Bloomberg) — Exxon Mobil Corp. pledged to safeguard its mammoth dividend after posting its first annual loss in at least 40 years, a show of defiance by an oil driller besieged by activist investors, lawmakers and climate-change campaigners.

Exxon assured investors of its financial health in a world of $50-a-barrel oil and promised that if crude were to dip to $45 it would sacrifice spending in the name of dividends. The Western world’s largest oil explorer has so far avoided the sort of payout cuts adopted by rivals Royal Dutch Shell Plc and BP Plc.

The dividend pledge comes on the heels of a $19.3-billion writedown of U.S. natural gas and other assets, and the lowest production since the 1999 Mobil Corp. merger. Cash flow from operations — a key gauge of corporate strength — shrank by almost 9% during the final three months of 2020 to $4 billion.

Investors looked past all that and boosted the stock by 2% to $45.82 at 9:33 a.m. in New York. Exxon’s $15 billion-a-year payout has a 7.56% yield and is third-highest in the S&P 500 Index.

“The focus will remain on cash-flow generation and while it wasn’t great in the quarter, Exxon did provide guidance on covering the dividend with oil at $50 a barrel,” Giacomo Romeo, a London-based analyst at Jefferies International Ltd., said in a telephone interview.

Excluding the historic impairment, Exxon returned to profit in the fourth quarter, earning 3 cents per share, and ending a run of three consecutive quarterly losses. That compares with the Bloomberg Consensus estimate for a 2-cent profit.

Exxon is emerging from the wreckage of 2020 facing the worst crisis in its modern history. In addition to growing criticism of its environmental record, financial performance has deteriorated. Exxon hasn’t increased payouts since early 2019.

“We remain focused on increasing long-term value for our shareholders,” Chief Executive Officer Darren Woods said in a statement. “The past year presented the most challenging market conditions ExxonMobil has ever experienced.”

Such was the pressure exerted by last year’s price collapse that Woods held preliminary talks with his counterpart at Chevron Corp. about a megamerger, the Wall Street Journal reported Sunday.

Before Tuesday’s reassurances, some investors had been worrying the oil titan might resort to a cut to shore up its cash position. As recently as October, the company was still pledging to increase payouts, but that changed a month later when management dropped the word “growing” from its discussion of dividends.

To read about Exxon’s newest director, click here.

Exxon isn’t alone in facing serious challenges even as commodities are on a tear. Chevron disappointed investors at the end of last weak with a surprise loss grounded on weaker-than-expected refining margins. Earlier Tuesday, BP Plc squeezed out a small profit that was a fraction of what the explorer earned in pre-pandemic days. ConocoPhillips posted a third consecutive loss.

As he begins his fifth year as CEO, Woods is taking an axe to capital spending and operating costs, all but abandoning his circa 2018 blueprint for expanding output while drilling and construction costs were low. Exxon announced 14,000 job cuts, delayed megaprojects from the Permian Basin to Mozambique, and has pledged to keep a tight rein on spending through the middle of this decade.

To explore into Bloomberg Intelligence’s ESG insights and data, click here.

The cutbacks helped turn Wall Street analysts more positive on the stock, especially with oil prices rebounding this year, but investors are still nursing deep losses after a 41% plunge in 2020 and years of underperformance compared with peers.

Exxon announced plans on Monday to set up a new business called ExxonMobil Low Carbon Solutions that will spend $3 billion on low-emission technologies through 2025. The slate of projects included several previously announced initiatives.

What Bloomberg Intelligence Says

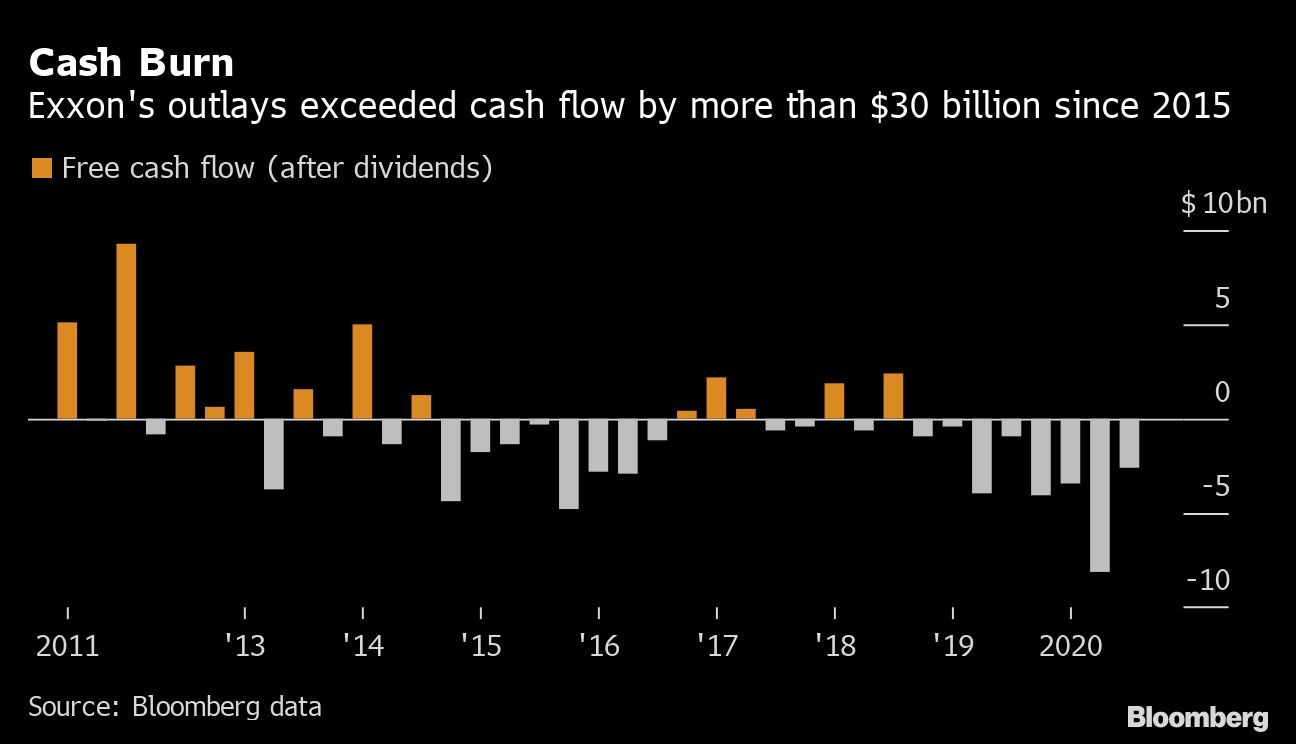

Exxon Mobil’s investment pullback may not be enough to protect the $15 billion dividend; it can likely maintain a dividend through 2021, but at the expense of long-term returns. A countercyclical investment strategy has been reduced to a near standstill, but the company is still churning through cash.

— Fernando Valle and Brett Gibbs, BI analysts

Read the report here.

Last week, activist investor Engine No. 1 formally took up the cause for a change in strategy, nominating four directors to the board ahead of Exxon’s annual meeting in May. The investor, which has the support of the California State Teachers’ Retirement System, is calling on Exxon to invest more in clean energy, commit to reducing emissions and improve returns on capital.

Meanwhile, the company is in talks with investor D.E. Shaw & Co. that may lead to additional director nominations in the weeks ahead, according to people familiar with the matter. On Tuesday, Exxon appointed former Petronas CEO Tan Sri Wan Zulkiflee Wan Ariffin to its board and said it’s talking to other director candidates.

(Updates share price in fourth paragraph, adds analyst’s comment in fifth paragraph)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

Originally published February 2, 2021, 6:41 AM